What Factory Owners Should Know About Carbon Credits & Green Financing?

India’s industrial sector is facing a new era of environmental accountability.

With the government’s ambitious net-zero targets and the launch of the Carbon Credit Trading Scheme (CCTS) in 2025, carbon credits have shifted from being a “nice-to-have” to a business necessity for factory owners. These credits are now a key part of compliance, cost management, and even reputation building in the global market.

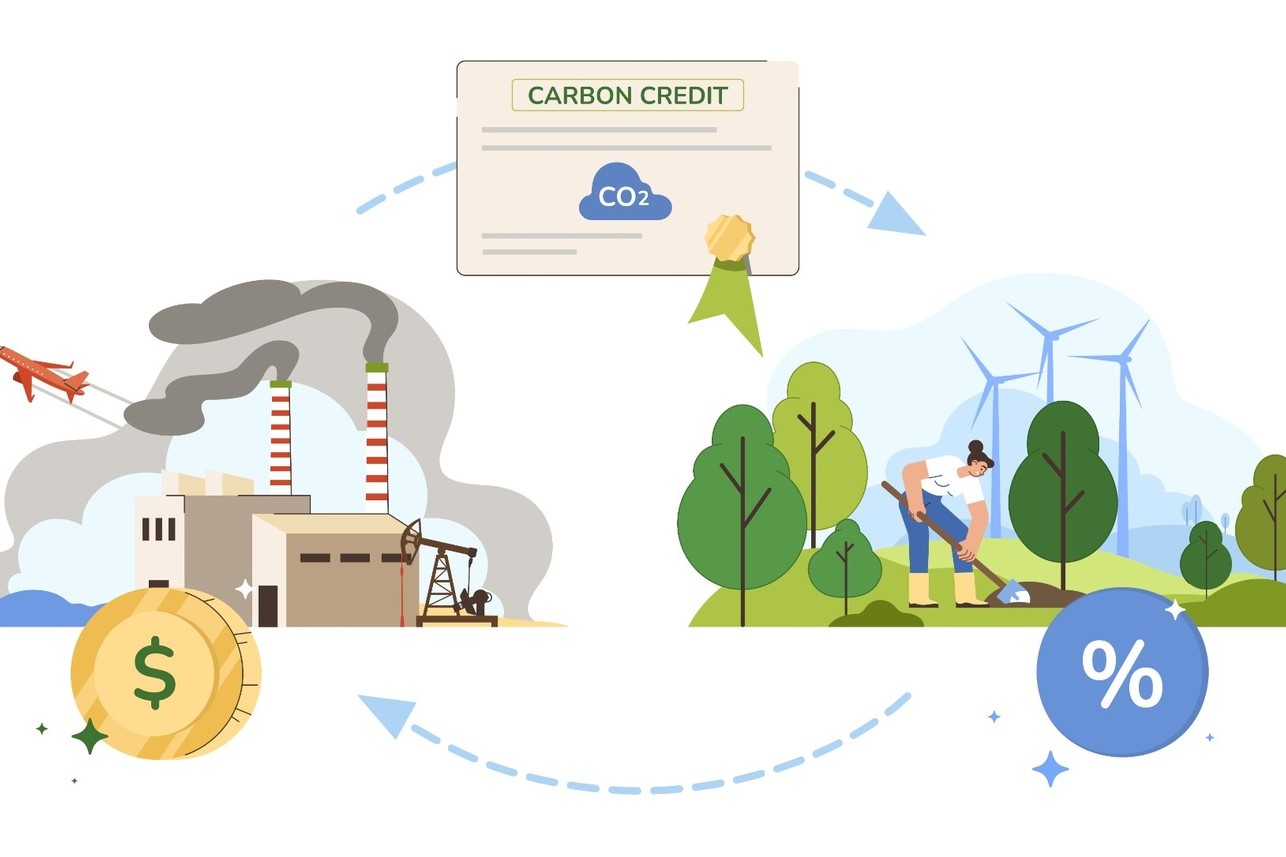

What Exactly Are Carbon Credits and How Do They Work?

A carbon credit is a tradable certificate representing the reduction or removal of one metric ton of carbon dioxide (CO₂) or its equivalent greenhouse gases from the atmosphere.

Factories that emit less than their allowed quota can sell their surplus credits, while those exceeding limits must buy credits to offset their emissions. This creates a financial incentive to cut pollution and invest in cleaner technologies.

India’s new CCTS covers major sectors like steel, cement, power, and fertilizers, making participation mandatory for large emitters. The price of carbon credits in India is expected to start around $10 (₹800–₹950) per metric ton, but this could rise as demand grows.

How Can Factory Owners Benefit from Carbon Credits?

- New Revenue Streams:

If your factory reduces emissions below the sector benchmark, you can generate and sell carbon credits, creating a direct financial benefit.

- Cost Savings:

Investing in energy efficiency, renewable energy, or waste management can help you avoid the need to buy expensive credits in the future.

- Enhanced Brand Value:

Demonstrating climate action through carbon credits can improve your reputation with investors, customers, and regulators.

- Access to Green Financing:

Banks and investors are increasingly favoring companies with strong sustainability credentials. Carbon credits can help unlock green loans and lower-cost capital.

What Is Green Financing and Why Should You Care?

Green financing refers to loans, bonds, and other financial products specifically designed to fund environmentally friendly projects like solar power, energy-efficient machinery, or pollution control systems.

In India, green finance is growing rapidly, with schemes from SIDBI, public sector banks, and private lenders supporting everything from renewable energy to waste management.

Government-backed incentives, such as subsidies and low-interest loans, are also available for factories investing in green upgrades. These financial tools not only reduce your environmental impact but can also lower your operating costs and improve your competitiveness.

What Are the Latest Developments in India’s Carbon Credit Market?

Mandatory Participation

From 2025, large factories in sectors like steel, cement, and power must participate in the CCTS, with sector-specific emission targets for 2030.

Voluntary Carbon Markets

Smaller factories and those outside regulated sectors can still participate voluntarily, earning credits through projects like afforestation, biogas, or energy efficiency.

Agriculture and Rural Inclusion

Recent news highlights how farmers and rural communities are being brought into the carbon market, generating credits through sustainable agriculture and benefiting from new income streams.

Green Financing Growth

Banks and NBFCs are rolling out more green loan products, and the government is pushing for easier access to finance for MSMEs investing in sustainability.

What Are the Best Practices for Leveraging Carbon Credits and Green Finance?

Track and Report Emissions

Set up robust systems to monitor your factory’s emissions. Accurate data is essential for compliance and for claiming credits.

Invest in Clean Technology

Prioritize upgrades that reduce energy use, switch to renewables, or cut waste. These investments often pay for themselves through savings and credits.

Engage with Experts

Navigating carbon markets and green finance can be complex. Partnering with experienced consultants like VMS Consultants can help you maximize benefits and avoid pitfalls.

Stay Updated

Regulations and market prices are evolving. Keep an eye on government notifications and industry news to stay ahead.

What Are the Challenges and Risks?

While the opportunities are significant, there are challenges too. The carbon market is still maturing, and prices can fluctuate. Verification and transparency are crucial—poorly documented projects may not qualify for credits.

MSMEs may face hurdles in accessing green finance due to collateral or credit rating requirements.

However, with the right guidance and a proactive approach, these challenges can be managed.

Final Thoughts

The shift to a low-carbon economy is accelerating in India. With the right knowledge and understanding of carbon credits, factory owners can turn compliance into opportunity, boosting profit margins, brand recognition, and resilience.

Connect with VMS Consultants for expert support in engineering, architecture, and project management for your next sustainable project.

Let’s build a greener, more profitable future together!